Real Estate Bubble? Not In Spain

POSTED BY: THE CORNER 8TH SEPTEMBER 2022

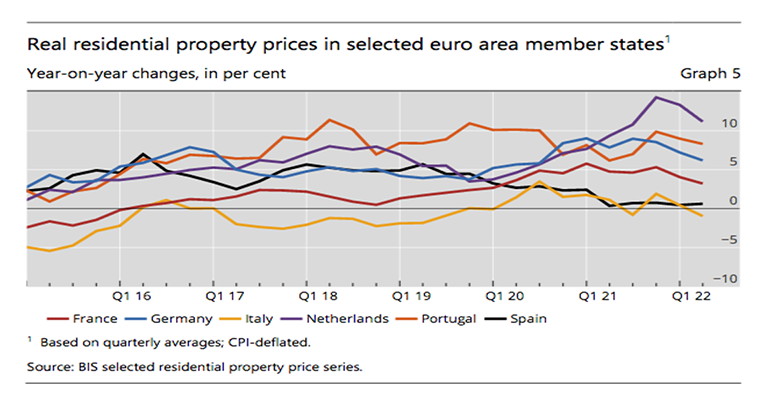

According to a report by the Bank for International Settlements, global real house prices increased by 4.6% year on year in aggregate in the first quarter of 2022. This strong growth in real terms reflected a surge (+11.2%) in nominal terms – the first double-digit one recorded since the eve of the Great Financial Crisis – partly offset by the acceleration in consumer price indices.

Real house price developments continued to diverge between advanced economies (AEs, +8.5% year on year) and emerging market economies (EMEs, +1.6 %).

Real house prices surged in Turkey (by around 35%), Canada (20%), Australia(14%) and the United States ( 12%). They fell by 3– 4% in Brazil and India.

In real terms, global house prices now exceed their immediate post-G FC average levels by 29%. They have been up by 41% in the AEs and by 19% in the EMEs.

In aggregate for the group of AEs, real residential property prices grew by 8.5% in Q1 2022, up from 7.8% in the last quarter of 2021. Prices rose in double-digit rates in Canada (+18%), Australia (+14%) and the United States (+12 %), reflecting marked nominal price growth (20–25%). They increased somewhat less vigorously in Japan(+8%) and the United Kingdom (+3%). Prices were up by 3% in the euro area, where developments continued to vary significantly among member states. Strong real house price growth persisted in the Netherlands (+11%), Portugal (+8%) and Germany (+6%). Real prices grew less rapidly in France (+3%), and remained roughly flat in Spain (+1%) and Italy (–1%)